Which of These Annuities Require Premium Payments

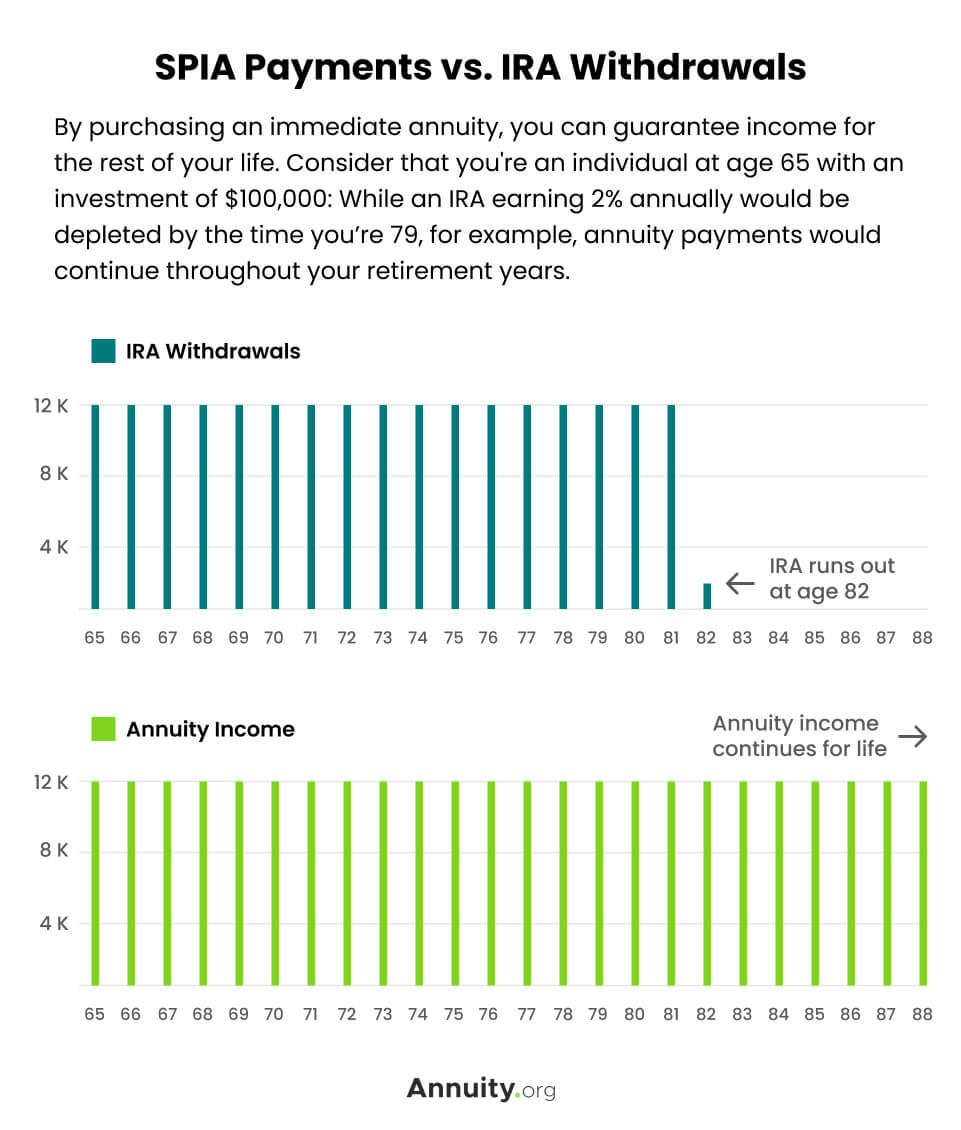

In many cases people purchase an immediate annuity which is also known as a single-premium immediate annuity. Ad Get Guaranteed Quotes From Over 25 Top Rated Companies.

Single Premium Immediate Annuity Spia Rates Pros Cons

Ad Learn More about How Annuities Work from Fidelity.

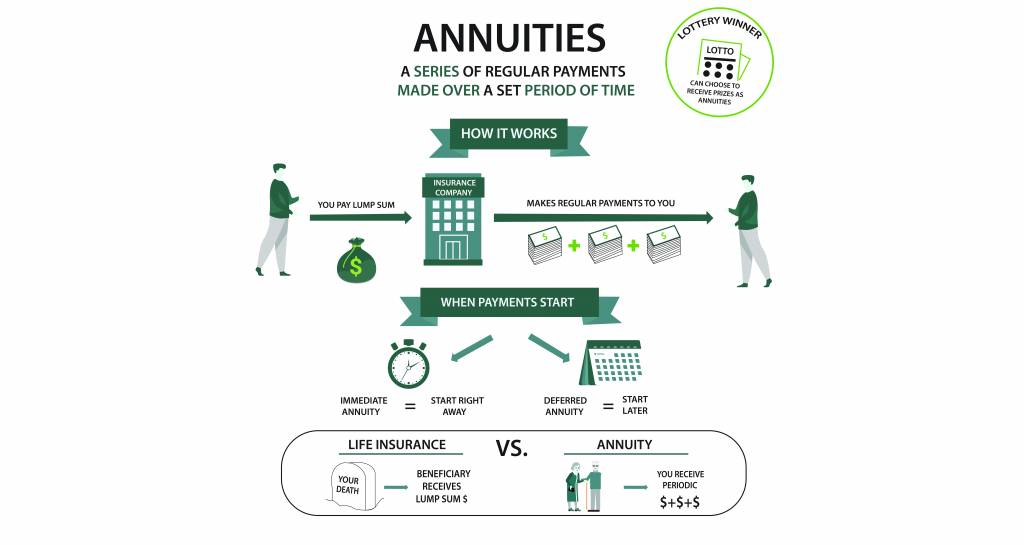

. Which of these annuities require premium payments that vary from year to year. Flexible premium deferred annuity. Deferred annuities for retirement can remain in the deferred.

There are various products that make use of this strategy. Which of these annuities require premium payments that vary from year to year. You should buy a SPIA if you want the.

Which of these annuities require premium payments that vary from year to year. The tax wont be added to your out-of-pocket premium payment. When you only make one payment into an annuity the approach is often called a single-premium strategy.

Explore Jacksons Innovative That Amplify Your Practice. One type of immediate annuity known as a single premium immediate annuity SPIA begins paying income within a year of the purchase date. Jacksons Suite Of Tools Can Highlight The Value Of Annuities To Prospective Clients.

If you buy an immediate annuity you will pay the premium tax up front. A single premium immediate annuity or SPIA is a great option for people who seek guaranteed periodic payments in the form of an income stream. Which of these annuities require premium payments that vary from year to year.

You usually pay for an immediate annuity with one. An annuitant dies during the distribution period. Which of these annuities require premium payments that vary from year to year.

An immediate annuity has been purchased with a single premium. Flexible premium deferred annuity. Which of the following is an annuity that is linked to a market.

Deferred income annuities DIAs are. Ad Support Your Clients Journey. Ad Learn More about How Annuities Work from Fidelity.

How do interest earnings accumulate in a deferred annuity. These annuities can be held in retirement and nonretirement accounts and work like an immediate annuity except payments begin 13 months to 40 years in the future. Jacksons Suite Of Tools Can Highlight The Value Of Annuities To Prospective Clients.

Which of these annuities require premium payments that vary from year to year. Under a non-qualified annuity interest is taxed after the. Which of these annuities require premium payments that vary from year to year.

What kind of annuity will return to a beneficiary. Simon has purchased a fixed immediate annuity. An annuity that has a flexible premium may be paid in a series of payments or through a combination of an initial lump sum and ongoing premium payments.

Flexible premium deferred annuity. Ad Support Your Clients Journey. Instead it will be deducted from the initial value of the.

On a tax-deferred basis. The payout might be a very long time. Flexible premium deferred annuity.

A deferred annuity receives premiums and investment changes for payout at a later time. Flexible premium immediate annuity Flexible premium deferred annuity Fixed premium deferred. Explore Jacksons Innovative That Amplify Your Practice.

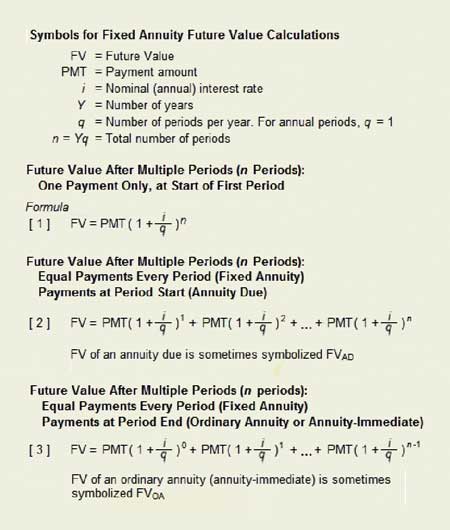

Annuity Formula Calculation Examples With Excel Template

Annuity Contracts For Investment Or For Creating Income Stream

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Contracts For Investment Or For Creating Income Stream

Annuity Contracts For Investment Or For Creating Income Stream

Annuity Beneficiaries Inherited Annuities Death

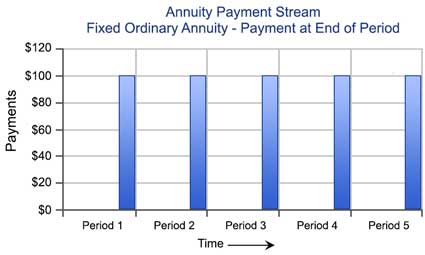

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

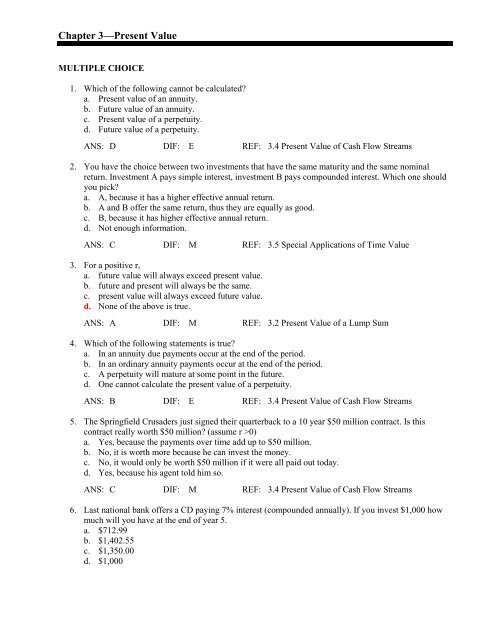

Chapter 3 Present Value Userpage

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Present Value Of An Annuity How To Calculate Examples

Annuities 101 Most Commonly Asked Questions And Answers Usaa

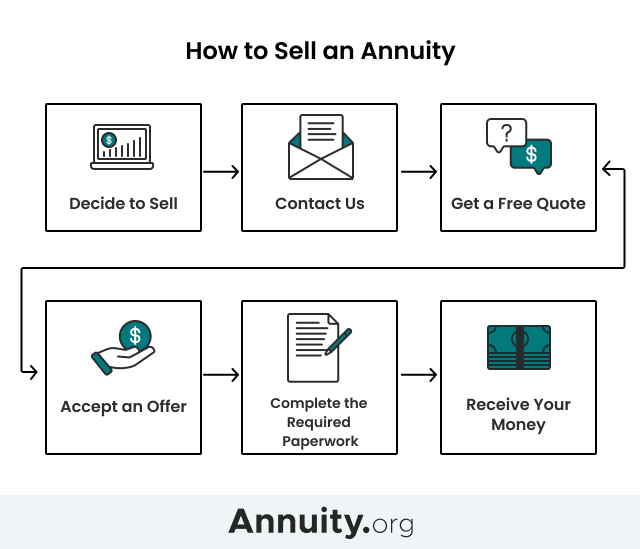

How To Sell Your Annuity Payments For Cash Step By Step Guide

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Contracts For Investment Or For Creating Income Stream

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Comments

Post a Comment